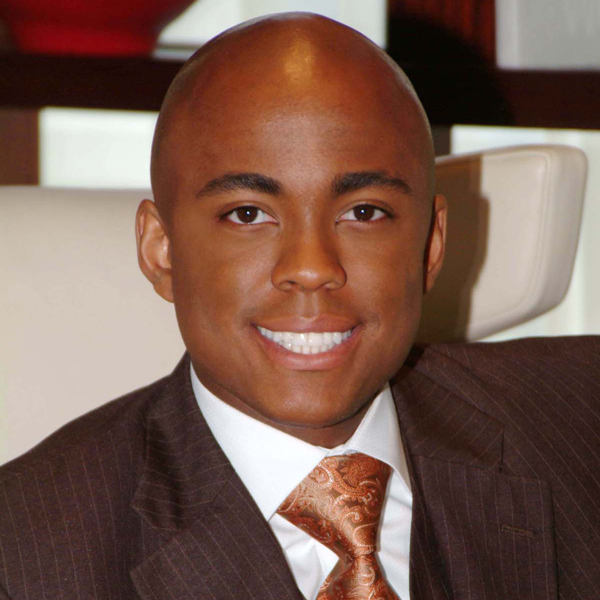

Peter Bielagus

- Young America's Financial Coach

- Known as the “Go-To Guy For Young People and Their Money”

- Author of three books on money management and creator of Youtube personal finance show Money In The Movies

In Person-Fee 🛈

$7,500 and Under

Virtual Fee:

$7,500 and Under

Travels From

New Hampshire

Peter Bielagus Speaker Biography

Peter Bielagus (Bill-a-gus) became a top authority on money management for Young America the hard way− by first falling deep into credit card debt. Peter entered college with several thousand dollars in savings but within 6 months he found himself $5000 in credit card debt. Determined to dig his way out of debt, Peter began learning about personal finance, reading over 300 books on the subject, interviewing experts and attending seminars. By graduation, Peter’s cards were clean and he was on his way to financial freedom.

Wanting to educate students and young professionals about money, Peter wrote Getting Loaded: A Complete Personal Finance Guide For Students and Young Professionals which was published by Penguin Putnam/NAL. After graduating, Peter went to work for a national financial company and became the top salesperson in his district, in his first year. Shortly after getting his financial planning license, Peter then opened up his own fee-only financial planning firm – one in the few in the country that catered exclusively to young people. A frequent guest in the media, Peter has appeared in the Wall Street Journal, USA Today and on the nationally syndicated radio show “Hints From Heloise.”

In addition to writing and speaking, Peter has created many financial education products, including the interactive CD-ROM, Mastering Your Personal Finances , and the 70 minute audio program The Free Way Guide To Personal Finance. He is now awaiting publication of his next book for young entrepreneurs entitled Quick Cash For Teens: Make Money and Be Your Own Boss to be published by Sterling in the Spring of 2009.

Affectionately known as the Go To Guy For Young People and Their Money Peter now gives over 100 presentations a year for high school and college students as well as members of the military. Recently financial corporations, credit unions, financial aid administrators and even parents have called upon him to assist them in getting Young Americans excited about personal finance. Mixing humor and emotion with real life examples, Peter empowers audiences of all ages to get started today on managing their money.

Jumpstart Your Personal Finances™

The Ideal Addition To A Pre-College Conference Or High School Senior Seminar

- Did you know that a student under the age of 18 can get a credit card without a parental cosigner? In fact about 11 % of teens have their own credit card and an additional 10% have access to a parent's credit card. (Source: Jumpstart Coalition For Personal Finance Literacy.)

- 74% of 13 to 21 year-olds report that their parents actively taught them how to manage money. (Source: Jumpstart Coalition For Personal Finance Literacy.)

- 70 % of college students surveyed said their parents have not given them tips or advice about spending wisely while shopping for school supplies. (Source: Jumpstart Coalition For Personal Finance Literacy.)

- The number of states with personal finance standards or guidelines dropped from 40 states to 31 states from 2000 to 2002. (Source: Jumpstart Coalition For Personal Finance Literacy.)

- Children's spending has roughly doubled every 10 years for the past three decades and tripled in the 1990s. (Source: Jumpstart Coalition For Personal Finance Literacy.)

- Personal Bankruptcies for people under the age of 25 are on the rise. (Source: Jumpstart Coalition For Personal Finance Literacy.)

- Four 19 year olds have approached Peter's financial planning firm requesting his help with personal bankruptcy!

The problem is getting worse while the education efforts are shrinking! Don't let your students become one of these sad statistics

In this high energy, high content presentation, Peter serves up an easy system to teach students the basics of personal finance. Students will learn how to avoid debt, use credit cards wisely and learn the importance of saving and investing. But not only will students learn, they'll DO. Every student will leave this talk with simple ways on how to get started on a savings plan that will put $100 in FREE money their pocket every year for the rest of their lives. Think it can't happen? Think again. Peter will show your students how.

How To Cut College Costs So That Any Student Can Go To The School Of Their Choice™

A Must For Parent College Seminars, College Conventions

College costs are on the rise. Which parents and students will be able to pay for it? After listening to this presentation all parents will. Former Financial Advisor, Peter Bielagus, will reveal never before heard secrets that the financial aid offices don't want parents to know.

Peter will show parents and students:

- How to get FREE money for college (beyond grants and scholarships) even if they don't have a clue.

- Why everyone needs to apply for financial aid.

- What the most common financial aid forms are, when to fill them out and most importantly, how to fill them out so they get a lot more money.

- How to immediately increase the chances for scholarships and avoid scholarship scams.

- How to save correctly save for college, and not lose out on financial aid.

- How to get a portion of the $1 billion in financial aid that goes unclaimed every year and that most everyone doesn't know they're able to get.

How To Put More Money In Your Pocket Today: A College Personal Finance Boot Camp™

This is Peter's most popular program!

Essential for Orientation, Senior Seminars, Graduate Programs, Career Week

66% of students have a mistake on their credit report that is not their fault. Will your students be in that 66% category?

Over 50% of college students have a below average credit report which will force students to pay up to $7000 in extra interest to buy the average car and up to $250,000 to buy the average house.

For every day a college student waits to start investing, they must work an extra week before retirement.

Peter will show your students:

- How to fix the errors on their credit report that are not their fault.

- How to find FREE money to get out of debt.

- The correct number of credit cards to have (hint: it's not zero and it's not 15!)

- How to get rid of credit cards without damaging their credit (that's right, if you do it incorrectly your credit will get damaged!)

- How to clean up their credit.

- How to start investing the moment the talk is over!

- The one investment that will put $100 a year in totally free money in their pocket every year for the rest of their life.

Peter was $5000 in debt by the end of his freshman year. But by using the simple strategies in this talk he graduated debt free and now his investments pay him money. He'll show students exactly what he did and how they can do it too!

Cash In On Your Passion: So You Can Land The Job Of Your Dreams™

Ideal For Career Week, Senior Seminars, Graduate Programs, or Job Fairs

Peter will show your students:

- How to leverage youth, major and passion to increase earning power.

- The true job hunting secrets that they probably haven't heard of before like:

Why a resume comes last not first

Why college students should avoid the human resources department

Why you should never speak to your boss over the phone

- What comebacks to use when employers tell them "you have no experience." And what comebacks that will get them the job!

- How to beat out any competition be they older, smarter, or even more qualified applicants.

- Ten Tips to get more money even if they say they don't have it!

- And most important...Get Hired!

Remember, Peter did not know a soul in the publishing business, but still managed to get his dream job. He'll show your students exactly how he got his dream job and how they can too!

Money Management For Greeks: Your Personal Finances And Your Chapter Finances

Because Peter is the ALL DAY speaker Greeks can benefit from TWO essential presentations for fraternities and sororities

Show your Greek members how to get control of BOTH their personal finances and their chapter finances. In these two high energy presentations former financial advisor Peter Bielagus will take students on a journey through the money mazes of personal finances as well as chapter finances.

Part 1: Your Personal Finances

Students will learn all about their credit score− that crucial 3 digit number that will affect their ability to borrow money, get insurance and even get a job. Peter will show students how to check their credit score and tell them the five ways to get their scores up. Students will also learn why their budgets aren’t working and what they can do about it. They’ll discover neat tricks to save more while spending less. Peter will even show students how to get some of the free money that is floating around on their campus!

Part 2: Your Chapter Finances

Peter firmly believes that if your personal finances aren’t in order, you’ll never be able to get your chapter finances in order either. In this second presentation, Peter offers practical answers to the problems organizations face every day like:

- Why isn’t our chapter ever on budget?

- This member won’t pay their dues, but other members don’t seem to care. What do I do?

- How do I handle the delicate balance of brotherhood/sisterhood and money?

Peter will show students how to create a simple chapter budget that works. He’ll reveal his system for ensuring dues get paid on time and even provide real world “comebacks” that officers can use when a member is dragging on their payments. Using actual examples from Greek organizations Peter has already worked with, he’ll show every officer how to get their chapter on the financial fast track. Peter is a brother in the Phi Kappa Theta Fraternity and conducts all of their national financial training programs.

Making Finance Fun: How To Get Young America Excited About The World's Most Boring Subject™

Great as Keynote or as a Workshop For Corporate Training, Parent Seminars or Teacher Conferences. A must for any corporation or association responsible for marketing to or educating young people about their finances.

Let's face it. Getting students excited about their personal finances can be like getting them excited about a root canal. Unfortunately, the subject of personal finance was long ago branded with the boring stamp. But it doesn't have to be that way. Let America's top expert on getting young people excited about their money show you how it's done.

Peter will show your audience:

- How to write copy to get young people interested. Find out how Peter got a room full of high school students to save for the college education of their kids!

- How to develop their own "financial lingo" to turn heads. Want to know what Peter has nicknamed the Roth IRA? Want to know how he refers to compound interest? Peter will share his own financial dictionary with your audience.

- Find out which topics in the realm of personal finance are attractive to young people. Peter will share his "Hot List" with your audience.

Associations and corporations have reached out to Peter not only for his expertise in personal finance for Young America, but also his presentation style. He has a unique connection to this age group. He'll show you exactly how he does it and how your audience can do it too!

How To Cut College Costs So That Any Student Can Go To The School Of Their Choice™

A Must For Parent College Seminars, College Conventions

College costs are on the rise. Which parentsand students will be able to pay for it? After listening to this presentation every parent and student will. Former Financial Advisor, Peter Bielagus, will reveal never before heard secrets that the financial aid offices don't want parents or students to know. Peter will show parents and students:

- How to get FREE money for college (beyond grants and scholarships) even if they don't have a clue.

- Why everyone needs to apply for financial aid.

- What the most common financial aid forms are, when to fill them out and most importantly, how to fill them out so they get a lot more money.

- How to immediately increase the chances for scholarships and avoid scholarship scams.

- How to save correctly for college, and not lose out on financial aid.

- How to get a portion of the $1 billion in financial aid that goes unclaimed every year and that most everyone doesn't know they're able to get.

"This Is The Time Of Your Life" And Other Damaging Statements Parents Say To Their Kids About Money Money Management™

Great for Parent Teacher Associations, Parent College Seminars, Parents Night

What are you saying to kids about money even if you're not saying anything at all? Find out what actions are leaving a strong (and possibly damaging) financial impression on kids. In this unique presentation, parents will learn:

- How to be a good financial role model, even if they don't have a clue about personal finance.

- Why they need to start talking now to their kids about money and what to say.

- Five tips to get their child(ren) excited about their own financial life, regardless of how old they are.

- The top five mistakes parents make in communicating financial lessons to their children (don't let damaging habits go on another day!)

- Remember the statistics:

50% of all American marriages end in divorce. The number one reason is money.

Over 100,000 people under the age of 25 declared personal bankruptcy last year.

Less than 25% of all the high schools in this country teach personal finance.

- It doesn't have to be this way. The time to start educating their child is now! Let America's top expert on young people and their money get them on their way.

The Final, End All, Brutally Honest Truth About Credit Scores

This talk fits in just about anywhere, as people of any age just cannot seem to learn enough about credit scores

When it comes to credit scores, it seems like everyone knows something, but no one knows everything. Listen to some of the questions Peter hears in his travels:

- "Closing old credit card accounts that I no longer use will raise my score...right?"

- "Someone told me that if I pay off an old debt I have in collections that will actually lower my score. That can't be true...can it?"

- "I heard from someone if you check your credit score it actually lowers your score. But then I heard from someone else that if you check your score it doesn't affect your score. Which is right?"

- "I have a great credit score, but no will give me a loan. What's the problem?"

In this powerful presentation, Peter lays down, once and for all the truth about credit scores. He clears up all the myths and misconceptions about the most important number in your financial life.

Jumpstart Your Personal Finances™ (60 or 90 minutes or customized all day or half day workshops)

An Ideal Workshop For Conferences, Human Resources Training, Or As Part Of An Employee Benefits

- According to a 2003 article in the Insurance Times, financially secure employees are more productive, more loyal and take fewer sick days. Your employees will learn the five secrets for becoming financially secure.

- Money is the number one cause of divorce in the United States and one of the leading causes of stress. Your audience will learn the five ways to reduce stress caused by financial troubles.

- 66% of people have a mistake on their credit report that is not their fault. Will your members and employees be in that 66% category? They will learn how to fix those errors.

- Over 50% of Americans have a below average credit score. A below average credit score will force a person to pay up to $7000 in extra interest to buy the average car and $250,000 in extra interest to buy the average house. Learn how to up your score and clean up your credit.

- Remember if your employees are worried about their own finances they won't be focused on company finances! Peter will set your group up with automatic money management strategies so employees will be focused on their work!

In this high energy, high content presentation, former financial advisor, Peter Bielagus, serves up a complete plan to Jumpstart Personal Finances. Your employees will:

Find FREE money to get out of debt.

- Learn the correct number of credit cards to have (hint: it's not zero and it's not 15!)

- Learn the five ways to get their credit score up (without working that hard.)

- What to buy and what not to buy (no general fluff, Peter gets very specific here.)

- Learn how to get rid of credit cards without damaging their credit (that's right, done incorrectly, their credit will get damaged!)

- How to find a qualified financial advisor (before an unqualified one finds you!)

- Learn if they're saving enough for retirement and discover the one investment that will put $100-$500 a year in totally free money in their pocket every year for the rest of their life. Peter will get them started on this investment the moment the talk is over!

Making Finance Fun: How To Get Young America Excited About The World's Most Boring Subject™

Great As Keynote Or As Workshop For Corporate Training, Parent Seminars Or Teacher Conferences. A Must For Any Corporation Or Association Responsible For Marketing To Or Educating Young People About Their Finances.

Let's face it. Getting students excited about their personal finances can be like getting them excited about a root canal. The subject of personal finance was long ago branded with the